Investors were not satisfied with the half-year figures of office furniture manufacturer Martela. The share, quoted on the Nasdaq, showed a 10% loss at the beginning of August, just after publication of the results of the first six months of this year, and closed at € 4.79. A year and a half ago, on January 3, 2017, Martela wrote a price per share of € 13.82. The cause of the decline last month, and the free fall of the past 18 months can be found in the continuously disappointing figures that the company presents. Last month, the company had to announce that its turnover remained virtually unchanged compared to last year, despite the economic growth in the Eurozone.

Investors were not satisfied with the half-year figures of office furniture manufacturer Martela. The share, quoted on the Nasdaq, showed a 10% loss at the beginning of August, just after publication of the results of the first six months of this year, and closed at € 4.79. A year and a half ago, on January 3, 2017, Martela wrote a price per share of € 13.82. The cause of the decline last month, and the free fall of the past 18 months can be found in the continuously disappointing figures that the company presents. Last month, the company had to announce that its turnover remained virtually unchanged compared to last year, despite the economic growth in the Eurozone.

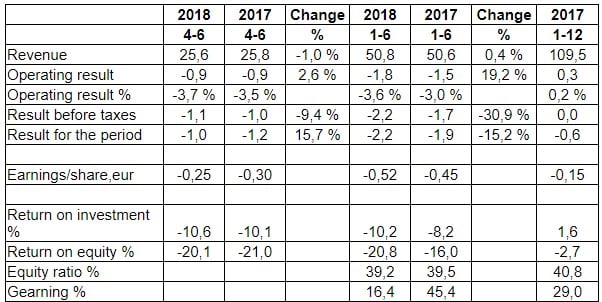

In addition, the result for the first six months of this year was worse than last year. Martela attributes the deterioration to increased competition with lower margins as a result. The operating loss of the company increased from € 1.5 million in the first six months of 2017 to € 1.8 million in the first six months of the current year.

‘Martela Lifecycle model progressing as planned’

‘Martela Lifecycle model progressing as planned’

In an explanation of the figures, CEO Matti Rantaniemi wrote: “The January-June 2018 revenue slightly increased compared to the previous year. Operating result declined compared to last year at EUR -0.3 million, being EUR -1.8 million (-1.5). Revenue for January-June was EUR 50.8 million and increased by 0.4% compared to the previous year. Revenue increased both in Finland and Norway, but decreased in Sweden and in other countries. I am very pleased that revenue in Finland is almost at the same level in 2016 and that is what Martela Lifecycle -strategy is generating positive results in Norway. Changing the sales channel to Martela Lifecycle model in Sweden is progressing as planned. New orders in Finland and Norway grew in the first half of 2018 compared to last year, and declined in Sweden and in other countries. Overall Education market in Finland compared with previous year.

Operating result compared with the same period last year. This was mainly influenced by increased competition. Operating results were negatively impacted by short term investments to improve the customer experience. Delivery accuracy has remained excellent and is considerably better than in 2016 or 2017. We have also continued to invest in developing the Martela collection.

Operating cash flow improved significantly and was EUR 3.9 million at the end of the period (-11.2). Improvement was strongly driven by enhanced invoicing and improved turnover of receivables. Last year’s training and reallocation of resources has been reduced to normal operating level.

We believe that the market conditions will remain challenging and in the second half of this year, we will focus on improving sales volumes and operating results as well as strengthening our financial position. Utilizing the full capabilities of our new IT system will support us in achieving these goals. ”

Market cap

As a result of the continuous decline of the share, the value of the company fell to € 19,324 million, compared with € 57.431 million at the beginning of 2017. In the current growing market, I will not be surprised if Martela is taken over in the foreseeable future by a furniture manufacturer who wants to quickly gain a firm foothold in the Nordic countries.